EnergyOMNI's Perspectives I Global Wind Energy Council Proposes Risk-Sharing Mechanisms for Offshore Wind in the Philippines

EnergyOMNI's Perspectives I Global Wind Energy Council Proposes Risk-Sharing Mechanisms for Offshore Wind in the Philippines

Edited by EnergyOMNI

In September, the Global Wind Energy Council (GWEC) released a report titled "Financing the Offshore Wind Revolution: Risk-Sharing Mechanisms for a Sustainable Energy Future in the Philippines," providing recommendations on financing and risk-sharing structures for the country's upcoming offshore wind auctions.

The report first introduces the structure and regulatory framework of the Philippine power sector. The industry has been fully liberalized, allowing private sector participation in generation, distribution, and retail. The national transmission grid, however, is operated by the National Grid Corporation of the Philippines (NGCP) and the National Transmission Corporation (Transco). In 2022, the Philippine government further amended its Renewable Energy Law to allow 100% foreign ownership of renewable energy projects.

Independent power producers(IPPs) in the Philippines have the option sell its output with the government or the private sector, including Power Purchase Agreements (PPAs) with distribution utilities or electric cooperatives, the provision of ancillary services, and participation in the Wholesale Electricity Spot Market (WESM). Renewable energy projects, meanwhile, typically secure capacity through the Green Energy Auction Program (GEAP), entering into Renewable Energy Purchase Agreements (REPA). The Philippines is expected to launch its fifth round of auctions (GEA-5) this year, offering 3.3 GW of offshore wind capacity.

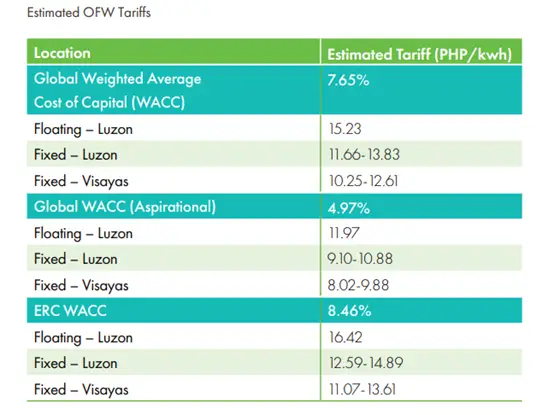

As of now, the Energy Regulatory Commission (ERC) and the Department of Energy (DOE) have yet to announce the guaranteed purchase price for GEA-5. According to a March 2024 study by the Asian Development Bank (ADB), the estimated minimum tariff for Philippine offshore wind projects ranges between PHP 9.1 and PHP 16.4 per kWh (around NTD 4.75–8.57). Earlier, local media cited industry sources suggesting prices may fall between PHP 10 and PHP 12 per kWh (around NTD 5.32–6.27). The GWEC report further calculates possible offshore wind tariffs—both for fixed-bottom and floating projects—based on different weighted average costs of capital (WACC) in Luzon and Visayas, as detailed in the table below.

Source: Financing the Offshore Wind Revolution: Risk-Sharing Mechanisms for a Sustainable Energy Future in the Philippines (GWEC, 2025)

The GWEC report concludes with several recommendations. First, it calls for enhancing public sector financial participation in offshore wind projects. This includes concessional financing and technical assistance from Multilateral Development Banks (MDBs) and Development Finance Institutions (DFIs) to support early-stage activities such as resource assessments and feasibility studies. The Philippine government is also encouraged to involve its Government-Owned and Controlled Corporations (GOCCs) in offshore wind development, either through direct or indirect equity participation. In addition, the government should proactively engage with Export Credit Agencies (ECAs) from countries supplying key offshore wind components (e.g., turbines and foundations) to broaden financing options.

On the policy support side, the government has multiple roles to play in facilitating project development. One key area is maintaining flexibility in project grid connection timelines. Project delays are common in new offshore wind markets. GWEC recommends that the Philippine government provide support in cases of delay. For example, if a project's commissioning and grid connection is postponed primarily due to slow delivery of government commitments, developers should have the ability to recoup expenses from the government/reimbursed through auto-adjustment of rates/ contract tenors.

The report also recommends establishing a central task force for offshore wind projects to coordinate across different government agencies/departments and to improve communication between central and local governments. At the Department of Energy (DOE) level, it could establish a dedicated offshore wind technical assistance initiatives related to offshore wind financing.

In its conclusion, GWEC emphasizes that effective risk-sharing mechanisms are essential to improving project bankability and are a key to successful offshore wind development. Efficient risk-sharing requires coordination among all stakeholders. The government's main responsibility is to mitigate regulatory and policy risks. ECAs, DFIs, and MDBs can help assume early-stage and political risks. Private developers are expected to assume commercial and technological risks; commercial banks can provide financing under risk-mitigation terms; and insurers play a role in protecting against construction and operational shocks. A well-functioning ecosystem will strengthen project bankability and accelerate the Philippines' energy transition.

More related articles