From Power Cables to Energy Storage: How Tun Green Power Is Redefining Global Storage Standards with Heavy-Electrical Engineering — A Taiwan-Style Solution

From Power Cables to Energy Storage: How Tun Green Power Is Redefining Global Storage Standards with Heavy-Electrical Engineering — A Taiwan-Style Solution

By Xin-En Wu

Founded in 1949 under the name TA TUN ELECTRIC WIRE & CABLE , Tun Green Power has long been one of the core suppliers in Taiwan Power Company's grid construction ecosystem. Its technical capabilities span the full voltage spectrum—from 15 kV distribution cables to 345 kV extra-high-voltage (EHV) transmission lines—covering manufacturing, installation, and turnkey construction.

"High-voltage and extra-high-voltage power cables represent a market with extremely high technical barriers," said Mei-Ling Lin, Chairperson of Tun Green Power.

"From material formulation and type testing, to manufacturing process certification, field delivery records, and the requirement of five consecutive years with zero incidents—combined with Taipower's on-site audits— achieving certification across the full 15 kV to 345 kV range typically requires more than 40 years of accumulated expertise. This is fundamentally different from most industrial sectors."

Taipower's qualification regime is particularly stringent. Contractors must progress step-by-step—from 15 kV, 25 kV, 69 kV, and 161 kV, up to 345 kV—before being granted EHV certification. While Ta Tun's work rarely interfaces directly with end users1 and thus remains largely invisible to the general public, its long-term involvement in public infrastructure, military projects, and the national grid positions it as one of Taiwan's most critical yet understated pillars of power system resilience.

As the rapid deployment of renewable energy and photovoltaic systems intensified, Taiwan’s grid began facing mounting pressure and increasingly pronounced feeder bottlenecks. Drawing on its deep heavy-electrical engineering heritage, Ta Tun was among the earliest to identify this structural shift. In response, Mei-Ling Lin―a member of the founding family―established Tun Green Power in 2022, with the aim of addressing real-world system requirements rather than pursuing speculative, market-driven investment.

The Guardian of Energy Storage Systems

As renewable energy and photovoltaic deployment accelerated, Taiwan's power grid began facing mounting stress and feeder bottlenecks. Drawing on its heavy-electrical engineering heritage, Ta-Tun was among the first to recognize this shift. In 2022, Mei-Ling Lin—representing the founding family—established Tun Green Power, aiming to address system-level challenges from an engineering perspective rather than engaging in speculative market entry.

"For companies like ours, rooted in power cables and heavy electrical engineering, we have an intuitive understanding of the pressures Taipower is facing today," Lin explained. "Our work has never been limited to cable manufacturing. We are involved from routing and installation all the way to the interface between generation plants, primary substations, and secondary substations. We understand grid stress at a level few others do."

Unlike the prevailing industry approach—land first, feeder later —Tun Green Power reverses the logic. By identifying weak grid zones based on decades of network construction experience and only then siting projects, the company has been able to complete seven projects within six months, covering the entire process from application and design to construction. Speed and precision have become its defining competitive edge.

"After four years, if I were asked where Tun Green Power truly stands," Lin reflected, "I would say we have never left the world of heavy electrical engineering. At our core, we are engineers and manufacturers. That mindset—cultivated through manufacturing—does not lend itself to pure trading or transactional business models. We are used to laying cables ourselves, installing systems, operating and maintaining them, and solving problems on site. Once you walk this path, there is no turning back. It defines our value."

Despite common misconceptions, Tun Green Power is not merely an agent for CATL. Lin is explicit in defining the company's role as a guardian of energy storage system integrity . Because most projects are self-developed and self-invested, Tun Green Power must fully understand system fundamentals, maintenance, and repair mechanisms. Its partnership with CATL is therefore built on technical alignment and safety assurance—not brand representation.

"We design our own sites, invest our own capital, and operate and maintain the systems ourselves," Lin said. "That makes us simultaneously the developer, investor, user, and O&M provider. We must know exactly how equipment is repaired, how it is operated, and how it performs under the highest safety standards. There is no room for ambiguity. That is why we follow CATL's technical roadmap—not because of the brand, but because the technology must stand up to on-site risks and responsibilities."

Tun Green Power's heavy-electrical background also gives it a structural advantage in AC-side architecture, EHV interconnection, and system safety—creating a natural division of labor from firms primarily rooted in low-voltage or weak-current systems.

Given Taiwan's heightened sensitivity to cybersecurity and energy system security, Lin believes the island will inevitably develop localized energy storage solutions. While markets such as Japan and Australia may not impose the same degree of stringency, Taiwan's conditions demand higher standards. Tun Green Power has therefore adopted a strategy of site-specific localized system integration , while simultaneously expanding into Japan and Australia.

"Our goal is to extend the manufacturing ethos of heavy electrical engineering—real investment, real project records, and proven system stability," Lin concluded. "Beyond Ta-Tun's century-long blueprint, we aim to chart the next fifty years. By adhering to a 'second-place philosophy' and staying close to global battery evolution, we are building a Taiwan-originated energy storage ecosystem through differentiated system designs tailored to each market."

Turning Specifications into Value: Building "Luxury-Grade" Energy Storage Sites with Heavy-Electrical Standards

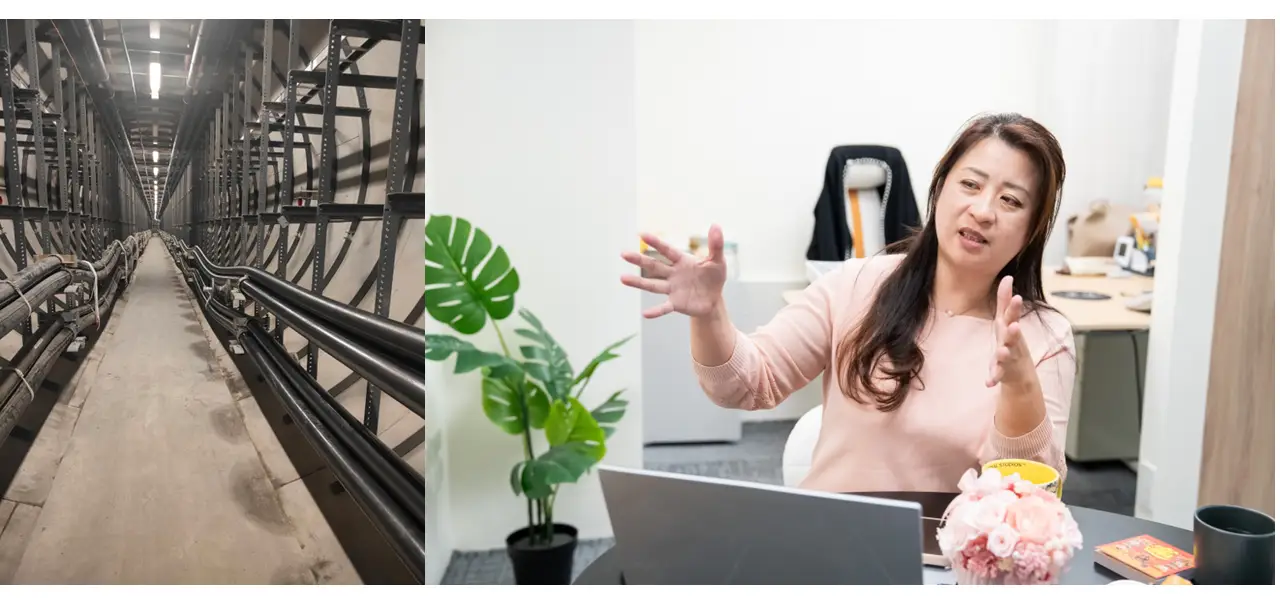

An underground cable tunnel for extra-high-voltage transmission lines, extending to depths exceeding that of a twelve-story building.

Power cables are often perceived as mundane materials, yet high-voltage cables are, in reality, products of advanced engineering, governed by rigorous standards from materials and routing to testing. "At Ta-Tun, we operate Taiwan's newest and largest 345 kV impulse laboratory, capable of simulating lightning strikes up to 1.25 million volts," Lin explained. "To safely dissipate impulse energy, our test site requires grounding electrodes driven more than 1.2 kilometers into the earth, ensuring ultra- low resistance and completing the full test protocol."

In construction practice, EHV cables—approximately 30 centimeters in diameter and copper-cored—have limited bending radii. Underground tunnels must therefore be excavated to depths equivalent to a twelve-story building, with conduit layers three to four meters high, accommodating dual-circuit designs and curvature allowances. Beneath many provincial and county roads lie these massive grid corridors, largely invisible to the public.

High-voltage cabling, Lin emphasized, is not a consumer market but a domain defined by heavy capital investment, extreme engineering thresholds, and longterm technical accumulation—each step directly linked to national grid security. This is why cable manufacturers remain low-profile despite being foundational to Taiwan's energy transition.

Misinterpretations surrounding energy storage safety, Lin observed, often stem not from storage technology itself but from deficiencies in cabling and grounding. "People say over 90% of residential fires originate from electrical wiring. Energy storage incidents follow a similar pattern. Most accidents do not arise from battery defects, but from connection works—improper crimping, unsuitable materials, incorrect conductor sizing. Under high current, even minor deviations can become risk sources. True safety lies not in equipment specifications, but in uncompromising execution of invisible details."

At 345 kV, connection materials remain largely controlled by Japanese suppliers, and only a handful of teams in Taiwan are capable of executing such terminations. Any deviation in procedures or materials can lead to arcing and overheating under high current, ultimately assigning the stigma of "unsafe" to energy storage systems. This is why Tun Green Power applies heavy-electrical standards to its storage projects—setting "luxury- grade" benchmarks. Grounding resistance targets are tightened from regulatory 10 ohms to an internal threshold below 3 ohms; ceramic insulators replace resin alternatives; and grounding resistance is measured meter by meter to ensure uniformity.

"In Taipower's framework, storage systems must respond within milliseconds," Lin noted. "In Japan, many systems operate on 30-second response settings. These fundamentally different grid demands necessitate different equipment standards. We insist on ceramic insulators not because resin is inferior, but because 'acceptable' varies by context. Under millisecond-level response and instantaneous energy discharge, ceramic durability and stability have been proven on site, time and again."

Such rigor can sometimes cause friction with EPC contractors or AC equipment suppliers. Lin understands these concerns and respects professional boundaries. "I take things step by step, one issue at a time—without pressure—resolving misunderstandings through communication and eliminating risks upfront."

A Policy Pivot: From Grid-Connected PV to "Nowhere to Place" Commercial Storage

Over the past two months, Taiwan's energy policy direction has become increasingly clear: grid-connected photovoltaic expansion has nearly halted; agricultural and non-industrial land is now subject to full environmental review; and large-scale PV growth is unlikely over the next three years. Policy focus has shifted toward commercial and industrial storage and distributed energy resilience . While the direction aligns with international trends, execution on the ground reveals significant contradictions.

"Recent fire safety guidelines allow indoor installation for systems below 600 kWh," Lin explained, "but still require a three-meter buffer zone and a two-hour fire wall, which cannot be substituted by perimeter walls. Most residential or commercial sites simply do not have six meters of regular, contiguous space—plots are often irregular."

As a result, even publicly listed corporations face a paradox of "nowhere to place" storage. In practice, enclosures with two-hour fire resistance provide equivalent protection, yet regulators apply the strictest interpretation, rendering guidelines functionally unworkable. At the same time, storage systems are required to meet diesel backup standards—despite weighing up to 2.7 tons and being structurally unsuitable for rooftops or upper floors—placing disproportionate risk and warranty exposure on developers.

"If the government truly intends to promote 'energy stored among the people,'" Lin argued, "it should not simultaneously block PV deployment—immobilizing nearly half of viable surfaces like rooftops and carports— while imposing impractical construction requirements on storage. The focus should be on simplifying procedures, clarifying regulatory intent, relaxing feasible construction methods, and substituting technical measures such as reverse-power protection for procedural complexity."

The core challenge lies in the gap between policy vision and institutional design. While official narratives promote building-integrated PV and self-generation with storage, real-world implementation remains encumbered by lengthy permitting, technical reviews, and cross-agency coordination. Even small rooftop systems can require half a year and substantial professional fees—contributing to stalled progress toward the 20 GW PV target.

Regulatory volatility further undermines investment confidence. In contrast, Australia's privatized transmission and distribution, active ancillary services markets, and transparent pricing allow participants—aggregators or not—to understand the rules of the game. Taiwan's centralized dispatch and opaque cost structures leave developers unable to assess grid constraints, leading to simultaneous bottlenecks in PV integration and commercial storage deployment. If the government truly intends to realize the vision of "energy stored among the people," Lin argues that the starting point should be the simplification of application and permitting procedures for photovoltaic systems and energy storage, the reduction of unreasonable compliance friction, and—most critically—the opening up of transparency in power market information. Otherwise, the gap between political slogans and on-the-ground implementation will continue to widen.

Another less visible but equally critical issue lies in the approval process itself, which often hinges on the interpretation and technical understanding of individual case officers. Lin cited a past project undertaken by Tun Green Power involving the installation of photovoltaic systems in a residential development as an example. From the earliest design stage, the project adopted the concept of "buildings as photovoltaics," pre-configuring sloped rooftops at optimal solar angles for each household, along with rain-shielding structures, conduits, and mounting brackets. The intention was to allow residents, in the future, to deploy photovoltaic and energy storage systems at minimal construction cost, with high safety and aesthetic integration—potentially progressing toward near-zero-carbon buildings.

However, during the formal review and approval stage, "building-integrated photovoltaics" were still regarded as a cross-disciplinary and relatively novel design approach. As a result, some reviewing authorities adopted a more conservative stance in regulatory interpretation and technical assessment, applying conventional logic associated with rooftop add-ons or floor-area ratio management. This substantially constrained the original design flexibility. An integrated system that had initially been capable of meeting the daily electricity demand of two- to three-story townhouse residences was ultimately approved for only around 2–3 kW of installed capacity, preventing the system's overall performance and design integrity from being fully realized.

Grid Transparency Lagging Marketization: Taiwan's Institutional Barrier, Not a Technical One

"At the root, Taiwan's grid governance problem is not technical—it is informational opacity and lack of marketization," Lin stated. She cited an E-dreg project in Douliu, Yunlin, where Taipower restricted storage operation to eight hours daily due to feeder congestion. Yet Ta-Tun knew a 345 kV line scheduled for completion in May 2026 would relieve the constraint. Only after prolonged negotiation was the project approved. "Very few developers have access to such information. Most are forced to accept closed-door dispatch decisions without understanding why PV is encouraged while storage is restricted in the same area."

This opacity dampens confidence in Taiwan's behind-the-meter market. Without transparent data, cross-regional dispatch logic, or price signals—as seen in Australia or Japan—growth relies on subsidies and administrative discretion. When funding dries up or rules change, investment retreats. Without reforming the Electricity Act, decentralizing dispatch authority, opening data, and allowing prices to reflect system value, commercial storage and VPP models risk remaining trapped in subsidy-driven rhetoric.

Lin warned that even short-term regulatory turbulence can be enough to deprive economies that are highly dependent on exports and high-technology industries of a full decade of opportunity. She expressed hope that Taiwan's market rules will gradually move toward greater clarity and normalization, allowing technology to genuinely take root on the ground (left: Tun Green Power's Hualien energy storage site; right: Tun Green Power's project site in Japan).

Taiwan's stringent requirements on CNS standards, cybersecurity, and BMS hardware exceed those of any other market, forcing Tun Green Power to adopt customized specifications. "Taiwan is not incapable—it simply requires Taiwan-specific project standards," Lin said. "Our strategy is to prepare comprehensively here while exporting Taiwan-developed capabilities overseas."

In Japan, Tun Green Power front-loads design, modularizes manufacturing, pre-positions spare parts, and supplements local aggregators through cross-shareholding— exporting Taiwan's mature VPP and EMS know-how. In Australia, three MOUs have been signed, with 100 MWh of capacity targeted by Q3 2026.

Amid tightening environmental reviews and stalled hyperscale investments, Lin expressed concern over what she termed policy shock without market validation. "Japan's thirty-year stagnation reminds us that policy mistakes do not always accumulate slowly. Sometimes, short-term regulatory turbulence is enough to cost a nation a decade—especially one reliant on exports and high-tech industries."

Taiwan remains Tun Green Power's foundation for capability building; Japan serves as a classroom for institutional learning; Australia is the forward base for scaling and validation. Lin hopes Taiwan's market rules will stabilize, enabling technology to truly land. At the same time, Tun Green Power will continue transforming Taiwan's hard-earned experience into exportable solutions— building resilience across multiple markets rather than anchoring its future to a single policy trajectory.

1 For the general public, more familiar names in the power cable industry―such as Pacific Electric Wire & Cable (PEWC) or Walsin Lihwa―are primarily known for their building wires and cables commonly used in the commercial and residential construction market, which are the products most people are likely to encounter or recognize in everyday life.

More related articles