From Power Dispatch to Asset Lifecycle Management How BILLION Watts Is Carving a Non-Replicable Path in the Energy Storage Industry

From Power Dispatch to Asset Lifecycle Management How BILLION Watts Is Carving a Non-Replicable Path in the Energy Storage Industry

By Xin-En Wu

In an era of rapid renewable energy expansion, energy storage is no longer a supporting role but a critical node determining whether power systems can operate stably. Yet while much of the market still views energy storage primarily as "equipment" or an "engineering project," BILLION Watts has chosen a more challenging— but ultimately more enduring—path: entering from the design stage and treating energy storage as a fully managed energy asset across its entire lifecycle.

"If all we wanted to do was sell equipment or build projects, there would be no need for us to do things the way we do today," Chairman Pedersen Chen stated candidly at the outset of the interview. For him, BILLION Watts is not a product of chasing short-term energy trends, but a strategic choice grounded in long-term observation of structural shifts within the energy transition.

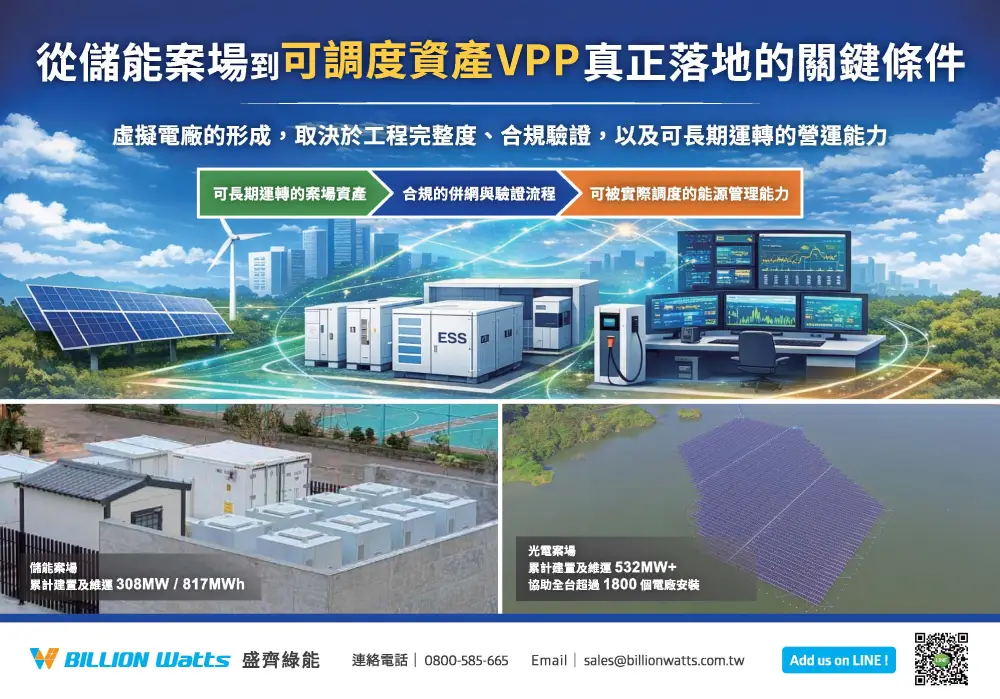

For Chen, Chairman of BILLION Watts, the company's mission is not a byproduct of short-term enthusiasm driven by the latest energy trends, but a deliberate choice shaped by long-term observation and structural understanding of the energy transition itself (Image: BILLION Watts's 1.3 MW / 3 MWh behind-the-meter energy storage project in Changhua, Taiwan).

Starting from Market Gaps: Why a Company Chose to Enter Energy Storage

Reflecting on the company's early days, General Manager Elaine Chen noted that even when BILLION Watts was small and resource-constrained, the team was keenly aware that simply following prevailing project construction models would make it difficult to establish genuine competitive differentiation.

"From the very beginning, we never believed that energy storage was something that ended once installation was complete," she explained. As early as 2017, when the market was still in its formative stage, the company focused on generation efficiency and long-term operational safety. Through the in-house development of the Pixel View photovoltaic monitoring system, BILLION Watts gradually expanded from equipment services into power plant management and operations and maintenance (O&M), accumulating substantial real- world operational data that later laid the foundation for its entry into energy storage.

With the launch of Taiwan's electricity trading platform in 2021, BILLION Watts proactively deployed energy storage and dispatch capabilities, cultivated specialized teams, and invested in frequency regulation and large-scale storage projects—demonstrating not only its ability to construct systems, but also its capacity to play a critical role in power markets and grid stability.

Renewable energy, by nature, is intermittent, while power systems demand stability and predictability. The gap between these two realities is precisely where energy storage derives its value—but it also entails highly complex system design, long-term O&M requirements, and significant capital risk.

For this reason, BILLION Watts chose, from its earliest stages, to allocate substantial resources toward product and system design capabilities rather than focusing solely on engineering construction. The company established dedicated R&D and system integration teams, incorporating considerations such as modular configuration for commercial and industrial storage systems, thermal management, moisture resistance, as well as future maintenance, replacement, and decommissioning feasibility—right at the design front end.

"We don't take off-the-shelf standard products and simply install them. Instead, we work backward from the operational perspective, asking what kind of product can truly be used over the long term," Elaine explained.

This choice subjected BILLION Watts to higher costs and risks in its early development, but it also gradually shaped a market positioning distinctly different from its peers.

Chen noted that from its earliest days, BILLION Watts made a deliberate decision to allocate substantial resources to product and system design capabilities, rather than limiting its focus to engineering and construction alone. To this end, the company established dedicated in-house R&D and system integration teams, incorporating front-end design considerations ranging from modular configuration of commercial and industrial energy storage systems, thermal management, and moisture protection, to the long-term feasibility of maintenance, replacement, and eventual decommissioning.

Design as a Service: Core Advantages and Three-to-Five-Year Outlook

When asked about BILLION Watts Green Energy's core strength, Chen pointed without hesitation to "lifecycle management."

In his view, energy storage is a long-lived asset measured over a decade or more. The real risk does not lie in whether a system can be successfully connected to the grid, but whether it can operate reliably for ten or fifteen years thereafter. "What you're buying is a highly technology-intensive, capital-intensive system. Without strong design and O&M support, the risks are actually very high," he said. Accordingly, BILLION Watts incorporates considerations for installation, operation, maintenance, and eventual decommissioning at the product design stage. Taiwan's environmental conditions—high temperatures, high humidity, and high salinity in certain regions— pose significant challenges for battery systems. If condensation and corrosion are not addressed at the design stage, O&M costs can rise sharply and even compromise safety.

"These details, if handled with standardized products alone, tend to surface as problems very quickly on site," Chen acknowledged. Having personally experienced such challenges, BILLION Watts has become even more convinced of the importance of design capability.

Looking ahead three to five years, Chen summarized the company's development goals along three axes. First, to continue accumulating storage deployment volumes that can be validated by the market, particularly in long-term O&M service performance. Second, to gradually replicate its design and O&M capabilities in overseas markets. Third, to deepen its role as an energy asset manager—positioning BILLION Watts not merely as a system supplier, but as a longterm partner to investors throughout the entire asset lifecycle.

"We want people to think of BILLION Watts not in terms of a single project, but as a company that can walk alongside them for twenty years," he said.

The Triple Challenge of Technology, Operations, and Policy

While Chen focused on positioning and long-term strategy, Elaine brought the discussion back to frontline operational realities.

"If there is one major difficulty today, it's not technology— it's regulation," she noted. Under Taiwan's current energy storage regime, projects span multiple regulatory authorities, and permitting and coordination processes are highly complex. Effective project execution therefore depends on vendors with comprehensive hands-on experience who have navigated the entire process themselves.

More critically, changes in market platform rules directly affect the predictability of capital recovery. "What we're seeing is that payback periods are being continuously extended—sometimes shifting from 'how long until break-even' to 'how much principal remains unrecovered,'" Elaine said candidly. For long-term infrastructure investments, this is a signal that warrants close attention.

In behind-the-meter markets, challenges take the form of spatial constraints and safety perceptions. Under existing fire safety and building codes, many factories that wish to deploy storage systems face limited space. Coupled with entrenched concerns about battery safety, this means that even where demand exists, projects often struggle to materialize.

"This is an industry that really needs to be properly understood," she emphasized. Modern energy storage systems feature 24/7 monitoring and international safety certifications. According to climate targets announced at COP30, the world must achieve approximately 1,500 GW of relevant deployment by 2030 to accelerate energy transition and address climate change. Energy storage safety standards have advanced significantly—but societal and institutional understanding must evolve in parallel with technology.

This is why BILLION Watts's overseas expansion— particularly in Australia—has become especially important. The company has already initiated multiple projects there at both distribution and transmission levels1. Transparent policies and clearly defined review processes make investment and technical planning far more predictable.

Elaine Chen noted that under Taiwan's current energy storage regulatory framework, project development spans multiple competent authorities, rendering the application and inter-agency coordination process highly complex and challenging. As a result, effective project advancement depends on vendors with comprehensive hands-on experience―those who have personally navigated the entire approval, construction, and commissioning process―so as to manage regulatory risk and move projects forward efficiently.

As for brand commitment, Elaine summarized it in three words: professionalism, safety, and trust. "We want the market to remember BILLION Watts as a company that treats energy as a responsibility to be managed, not as an opportunity to be exploited in the short term."

There are no shortcuts to fulfilling that commitment. Talent development, technology platforms, service systems, and policy engagement are all indispensable. "It's a slow road," she said, "but we've chosen to walk it for the long term."

As the interview concluded, BILLION Watts did not reduce systemic challenges to a single regulatory issue. Instead, the company identified three institutional elements it considers essential for the next phase of energy transition.

First, Elaine emphasized the gradual liberalization of the electricity market. Under current arrangements, energy storage participation remains relatively centralized, with limited trading counterparts and pricing mechanisms that fail to fully reflect temporal and seasonal supply-demand variations. As a result, it is difficult to price energy storage according to the actual value it delivers in system resilience and time-shifted supply.

Second, she highlighted the need to allow green power wheeling through energy storage. "If green electricity loses its green attribute once stored in a battery system, the role of energy storage in the green power value chain becomes constrained, limiting its overall value realization," she said. Allowing stored green power and surplus electricity to be wheeled—particularly for nighttime supply to enterprises with 24/7 demand—would make true 24/7 green power supply feasible.

The third recommendation concerns regulatory relaxation for off-site energy storage. BILLION Watts has observed that many high-consumption technology and manufacturing facilities lack the physical space required for behind-the-meter storage due to existing plant layouts and fire safety regulations. If regulations permitted centralized industrial-zone energy storage systems—serving multiple users through institutionalized wheeling mechanisms— it could address both land constraints and nighttime peak demand pressures.

Chen added that off-site energy storage fundamentally reframes storage as part of public power system resilience, rather than as an appendage to individual enterprises. "When energy storage operates in the right place, at the right time, overall system costs actually decrease and risks are distributed," he said.

He stressed that these proposals are not short-term policy demands, but natural directions for institutional evolution as renewable penetration rises and corporate green power demand structures change. "If Taiwan is to move toward a high-renewable, low-carbon, and resilient power system, these discussions are inevitable," he concluded.

1The key distinction between distribution-level and transmission-level projects lies in their interconnection voltage and where they sit within the power system. Under state-based Australian grid rules, transmission-level facilities connect to higher-voltage transmission networks—typically 66 kV, 132 kV, and 220 kV / 275 kV—and are most often large power stations or utility-scale renewable energy plants. By contrast, distribution-level facilities connect to lower-voltage distribution networks, with common connection voltages including 11 kV, 22 kV, and 33 kV. Located closer to end users, these projects are frequently distributed energy resources such as rooftop solar PV, and are typically managed by customers or local network business units.

More related articles